how to answer are you exempt from federal withholding

To calculate the FICA withholding for employees you must take the employees gross. You owed no federal tax in 2019 and.

Am I Exempt From Federal Withholding Do I Still Get A Refund Gobankingrates

Answer Yes if you want Federal income tax withheld from your railroad retirement payments.

. FICA mandates that three separate taxes be withheld from an employees gross earnings. Then submit the MI W-4P to your pension. If youre a US.

You may use Form W-4 to claim exempt from withholding if you meet the following conditions. Well show you exactly how to fill out the 2022 W-4 and well walk you through the worksheets and withholding estimator. Whether you can be claimed as a dependent on another person.

If you answer NO to item 6 remember that having no tax withheld from your annuity payments does not reduce the amount of the taxes you may owe. View and answer these questions to determine if you qualify to check the SSA Exempt box on Schedule 1 lines 22C andor 22G. The amount of your earned and unearned income.

Also youll need to submit a new W-4 every year if you plan to. Resident the factors that determine whether you owe federal income taxes or must file a federal income tax return include. Your status as a full-time student doesnt exempt you from federal income taxes.

659 and 5 CFR 581. The credit maximum is 54. 145 Medicare tax withheld on all of an employees wages.

All tips you receive are taxable income subject to withholding. By the federal SSA. Its the federal law that requires employers to pay and withhold certain taxes from the wages they pay employees.

If you are exempt from withholding write exempt in the space below step 4c. You will likely expect to owe no federal tax in 2020 and you wont have to file a federal income tax return if your income is below the filing requirement for your age. No as employee you do not have to earn a minimum income for federal and state income tax to be withheld.

Tip income you report will show up on your W-2 Box 7 Social Security tips and Box 1 Wages. If done this way the transaction will be tax-free for you. IRS Publication 15 Circular E has a table listing all the special rules for various types of services and payments for federal income tax withholding.

To incorporate this larger subtraction into the withholding from your retirement or pension benefits complete an MI W-4P and check the appropriate box. In this post well provide a quick overview of the 2022 W-4 for both employers and employees. The statutory basis exempting such educational grants is found at 20 USC1095a d and such grant monies are not subject to the inclusive provisions of 42 USC.

Most states allow you to charge the employee an administrative. Answer NO if you do not want Federal income tax withheld from your railroad retirement payments. All of this knowledge can help anyone complete the form with the best information possible based on their situation.

Appointments are recommended and walk-ins are first come first serve. FWS grants from the Department of Education are exempt from child support withholding. If you receive 20 or more per month in tips report that income to your employer.

FICA stands for the Federal Insurance Contributions Act. Illinois allows several exemptions from sales and use tax. The employee can earn a.

If you are entitled to such a credit your final FUTA tax rate would be the standard FUTA tax rate of 60 minus the credit. 25 of the employees disposable earnings or the amount by which an employees disposable earnings are greater than 30 times the federal minimum wage currently 725 an hour. All these factors determine the employees federal income tax withholding amount.

Federal income tax is based on the employees filing status number of allowancesexemptions earnings and the IRS withholding tax tables. The answer is that FICA taxes include Social Security taxes but are not just Social Security taxes. How does FICA impact you.

You still need to complete steps 1 and 5. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. For ordinary garnishments ie those not for support bankruptcy or any state or federal tax the weekly amount may not exceed the lesser of two figures.

Generally youre entitled to the maximum credit if you paid your state unemployment taxes in full on time and the state isnt determined to be a credit reduction state. Form 990 is an annual information return required to be filed with the IRS by most organizations exempt from income tax under section 501a and certain political organizations and nonexempt charitable trustsParts I through XII of the form must be completed by all filing organizations and require reporting on the organizations exempt and other activities finances governance. For a complete list of exempt.

Walk-ins and appointment information. See Publication 104 Common Sales and Use Tax Exemptions for a list of common sales tax exemptions and how tax-exempt sales must be documented. You expect to owe no federal tax in 2020.

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

Printable W 9 Forms Blank 2020 Fillable Forms Blank Form Irs Forms

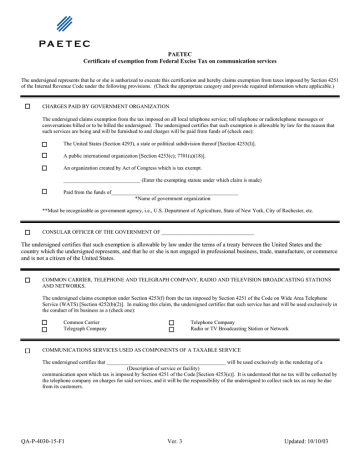

Federal Excise Tax Exemption Form Manualzz

Appendix 13c Income Taxes And The Net Present Value Method Answer Key Provided At The End Income Tax Income Net Income

Do I Pay Taxes On Workers Comp Larry Pitt

Who Is Exempt From Paying Income Taxes Are Some People Really Exempt From Paying Taxes Howstuffworks

Preparer Training Tax Services Directions Truth

Am I Exempt From Federal Withholding H R Block

A Beautiful Infographic To Share The Similarities And Differences Of Banks And Credit Unions Infographic Credit Union Credit Repair Credit Repair Services

Solved How Do I Make An Employee Exempt From Withholdings On Quickbooks

/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png)

Form 990 Return Of Organization Exempt From Income Tax Definition

How Do I Know If I Am Exempt From Federal Withholding

Monday Map State Income Taxes On Social Security Benefits Social Security Benefits Map Social Security

Irs Name Change Letter Sample Letter To Irs Free Printable Documents Address The Recipient By Name And State Letter Sample Name Change Business Template

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

How To Fill Out Irs Form W 4 Exempt Youtube

Solved How Do I Make An Employee Exempt From Withholdings On Quickbooks